Stablecoin World

A rundown on stablecoins and recent events in this space.

Stablecoins are cryptocurrencies with their value pegged to another currency, commodity, or algorithm to behave more predictably - most often to resemble the $1 peg.

Index:

I. Use cases

II. Stablecoin types

III. Recent events

IV. Stablecoins in numbers

I. Use cases

Safe Haven and trading hedge: as stablecoins are designed to be stable in price over time, their users utilize them in various ways. Traders secure profits by converting x cryptocurrency to a particular stablecoin instead of cashing out via offramps which usually incur higher fees.

Stablecoins proved an excellent solution for people residing in countries with high inflation. These citizens convert their native fiat currency to crypto stablecoins to protect their wealth.

Remittance: Cross-border payments come with high fees and long settlement waiting periods. Stablecoins can be sent from one crypto address to another with significantly lower fees and almost instantly, 24/7, 365 days a year.

Escrow: Smart contracts enable an automated escrow process, eliminating the need for a 3rd party centralized authority. In addition, all transactions are publicly visible to anyone with internet access.

Defi & alternative banking: Approximately 1.4b people are left unbanked. All that one needs to create a wallet, and access DeFi applications is an internet connection. It’s also crucial to stress the importance of self-custody by keeping your assets in a self-custodial crypto wallet.

II. Stablecoin types

Backed with Fiat: USD, EUR, GBP, etc

Commodity-backed: gold, metals, real estate

Crypto-backed: one or more cryptocurrencies as collateral

Algorithmic: backed with algorithms that control supply and achieve stability

Backed with Fiat

Fiat is ‘real world‘ money, the major global currencies widely used for everyday purposes like USD or EUR.

It’s not backed by commodities but rather by the governments that claim the power to issue and put it into circulation. The value of a particular fiat currency is derived from the supply and demand on the forex marketplaces.

Fiat stablecoins are pegged to specific fiat currency in 1:1 ratio; for every issued fiat stablecoin by the issuer, there’s one fiat currency posted as collateral with a financial institution.

The vast majority of stablecoin's total market cap belongs to fiat-backed stablecoins such as Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

Commodity-backed

These stablecoins use commodities such as gold, metals, or real estate as collateral to maintain stability and are considered less stable due to the higher price volatility of underlying commodities.

Gold is the most popular collateral in this category, it also enables investors to gain exposure to gold investment without possessing it physically.

The token is usually backed by one ounce of gold stored in the custodian’s vault and can be exchanged for other currencies or redeemed for physical gold at specific locations.

Paxos Gold (PAXG) and Tether Gold (XAUT) are the leading examples of commodity-backed stablecoins.

Crypto-backed

Crypto-backed stablecoins use one or more cryptocurrencies as collateral.

They leverage smart contract tech to lock cryptocurrencies provided as collateral and issue an equivalent amount of the stablecoin in return - a permissionless process with no centralized institution needed to hold the underlying asset.

These stablecoins are often over-collateralized to combat the volatility of collateralized assets.

DAI is the most prominent example of this category and requires 2:1 ratio - if you want to buy $1000 worth of DAI, you’ll have to lock $2000 of ETH.

Algorithmic stablecoins

Smart contracts and specialized algorithms manage the supply of tokens in circulation to peg the stablecoin’s value to $1 (or EUR, GBP, …)

No fiat, commodity, or other cryptocurrency is used as collateral as in previously mentioned stablecoin types.

The system:

reduces the price of tokens in circulation when the market price falls below $1

distributes new tokens in circulation when the market increases above $1

These are considered the riskiest types of stablecoins due to events surrounding TerraClassic (UST) debacle.

III. Recent events

Stablecoins have recently been a hot topic due to regulatory activity, custodians’ liquidity concerns, and the ongoing ‘battle‘ among big players aka Binance and Coinbase.

Regulatory activity

It’s still unclear who will regulate stablecoins and how. Most recently, Paxos (BUSD issuer) was ordered to stop minting and issuing BUSD by New York District of Financial Services, which resulted in a sharp decline in the BUSD market cap.

Custodian liquidity concerns

A prominent banker to the crypto industry (Silvergate Capital) announced to close operations and liquidate its assets. Circle, one of the USDC issuers, held approximately 25% of its cash reserves at Silvergate.

News about Silvergates' liquidity issues resulted in USDC losing its peg to $1 during the last weekend, which was later re-pegged at the beginning of this week. The current crisis in the banking sector could affect more stablecoin custodians, let’s hope that will not be the case.

The battle among big players

Competition in the stablecoin market is stiff. Binance (BUSD) and Coinbase (USDC) are trying to dominate the stablecoins market with their ‘native‘ solutions.

Coinbase suspended trading of BUSD, stating liquidity concerns in BUSD trading pairs.

Binance, however, stated that they intend to remain an open platform. They recently added BNB/USDC, BTC/USDC, and ETH/USDC trading pairs.

1-month total market cap change:

USDC -4%

BUSD -48%

For years, there has been a lot of FUD (Fear, uncertainty, and doubt) surrounding the biggest stablecoin in the industry - Tether USDT. Is Tether backed 1:1? Kinda impossible to know for a fact.

However, its peg to $1 seems firm for years with minimal volatility. The recent news by Wall Street Journal stated that Tether used falsified documents and shell companies to get to bank accounts. We’re yet to see how this plays out.

IV. Stablecoins in Numbers

At the time of writing, the total stablecoin market cap stands at $133.59b, 12% of the total cryptocurrency market cap.

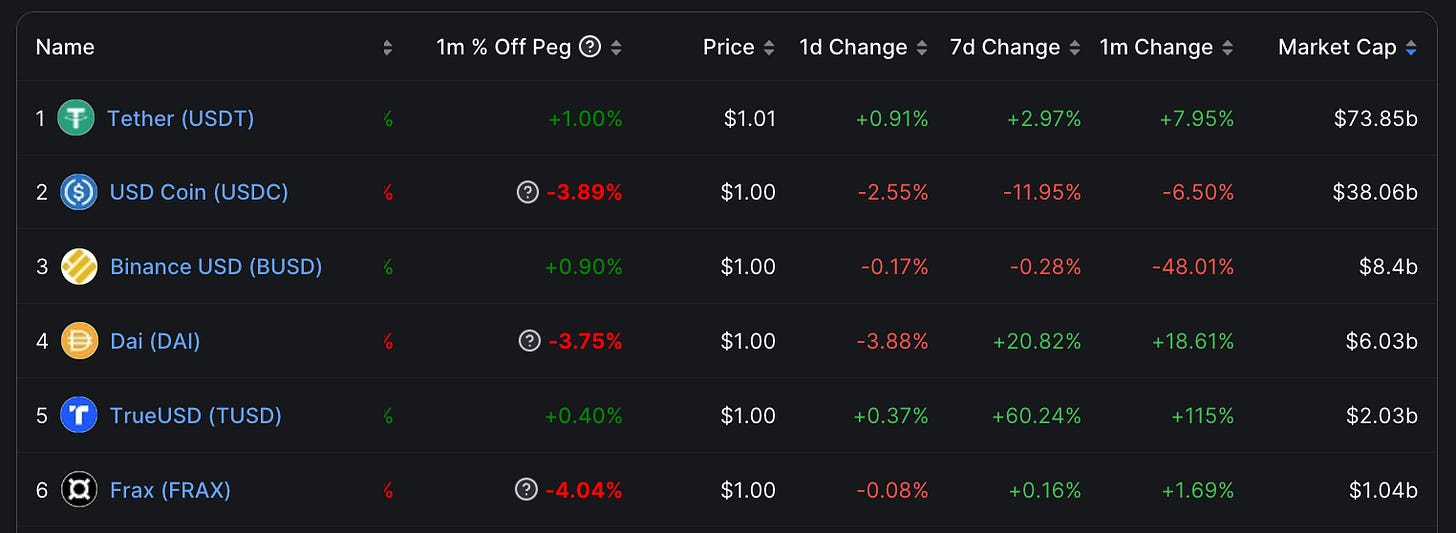

USDT is the current stablecoin dominator with 55% market share.

The volatility 1m% off peg in USDC, DAI, and FRAX is related to the recent drama surrounding the events with Silvergate Capital.

We’re seeing a sharp decrease in the BUSD market cap due to regulatory concerns. Conversely, more users seem to be pivoting to TUSD, DAI, and USDT.

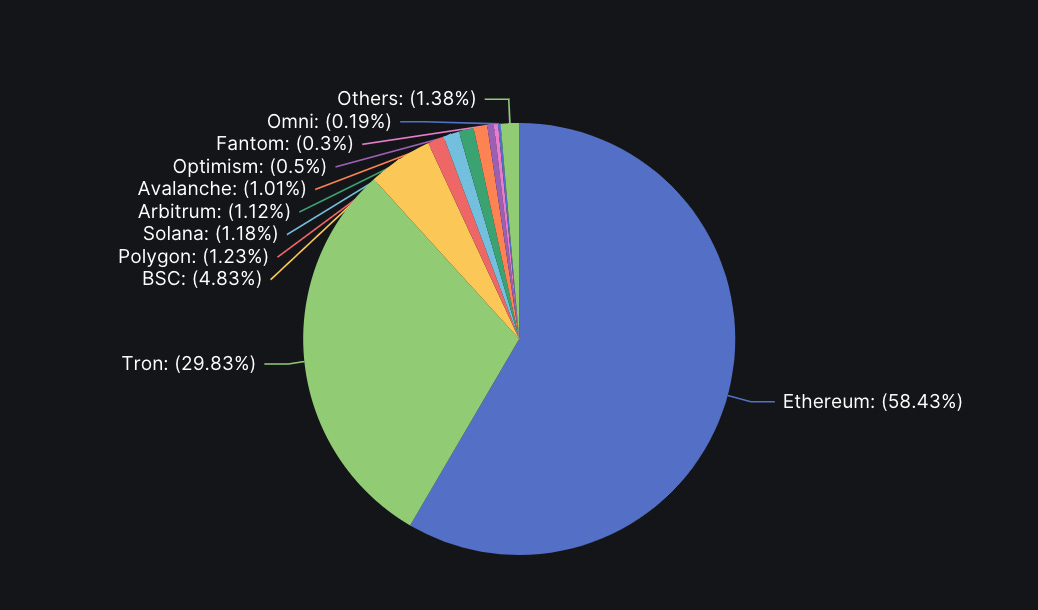

Stablecoins reside on various chains, with Ethereum and Tron chains being the absolute leaders. This can be attributed to the massive usage of stablecoins in DeFi applications on Ethereum, and low fees for sending transactions on Tron.

Thanks for your time!